Artículos

LONG TERM CARE PENSION BENEFITS COVERAGE VIA CONVERSION FACTOR BASED ON DIFFERENT MORTALITY RATES: MORE MONEY AS AGE GOES ON

LA PENSIÓN DE CUIDADO A LARGO PLAZO VÍA FACTOR DE CONVERSIÓN BASADO EN TARIFAS DE MORTALIDAD DIFERENTES: MÁS DINERO A MÁS EDAD

A PENSÃO PARA CUIDADO DE LONGO PRAZO VÍA FATOR DE CONVERSÃO BASEADO EM TARIFAS DE MORTALIDADE DIFERENTES: MAIS DINHEIRO PARA MAIS IDADE

LONG TERM CARE PENSION BENEFITS COVERAGE VIA CONVERSION FACTOR BASED ON DIFFERENT MORTALITY RATES: MORE MONEY AS AGE GOES ON

Interciencia, vol. 43, no. 1, pp. 9-16, 2018

Asociación Interciencia

Received: 13/09/2017

Corrected: 08/01/2018

Accepted: 09/01/2018

Funding

Funding source: Polibienestar Research Institute and Consolidated Research Group EJ/GV

Contract number: IT 897-16

Award recipient: This study

Abstract: This paper proposes a system for the automatic adjustment of pension benefits taking into account the mortality risk of the dependency level of the beneficiary. To that end, a simplified multi-state Markov chain model is included and the probability of death is estimated based on the experience of excess mortali ty rates. Thus, pension benefits increase in the new state as the cost of care increases. The paper does not seek to give a solution for severe or highly-dependent beneficiaries, but tries to make social sense of the benefit received and adapt it to their life expectancy: they receive more when they most need it. The development of the factor is applied to the Spanish mortality experience (PEM/F2000).

Keywords: Elderly, Pension Evaluation, Pension Schemes, Sustainability Factor.

Resumen: Este trabajo propone un sistema para el ajuste automático de la pensión teniendo en cuenta el riesgo de mortalidad según sea el nivel de dependencia física o mental del beneficiario. Para ello se aplica un modelo multiestado simplificado de Markov donde la probabilidad de fallecimiento se estima por medio de excesos de mortalidad sobre una persona no dependiente y basada en la experiencia. Así, el importe de la pensión aumenta en el nuevo estado, al igual que aumentan los costes del cuidado del dependiente. El artículo no procura dar una solución para beneficiarios dependientes en grado de severo o gran dependiente, sino que trata de dar sentido social a la pensión recibida y adaptarla a la esperanza de la vida: se recibe más cuando mayor necesidad hay. El desarrollo de este factor es aplicado a la experiencia de mortalidad española (PEM/F2000).

Resumo: Este trabalho propõe um sistema para o reajuste automático da pensão levando em conta o risco de mortalidade segundo o nível de dependência física ou mental do beneficiário. Para isto se aplica um modelo multiestado simplificado de Markov onde a probabilidade de falecimento se estima por meio de excessos de mortalidade sobre uma pessoa não dependente e baseada na experiência. Assim, o valor da pensão aumenta no novo estado, na medida em que aumentam os custos de cuidado do dependente. O artigo não procura dar uma solução para beneficiários com alto grau de dependência, mas sim trata de dar senti do social à pensão recebida e adaptá-la à expectativa de vida: se recebe mais quando maior necessidade existe. O desenvolvimento de este fator é aplicado à experiência de mortalidade espanhola (PEM/F2000).

This paper seeks to help draw up a flexible de sign for pensions for dependents that can help reduce the costs of their situation while precisely increasing the amounts that they receive. This requires a system for the automatic adjustment of pension benefits taking into account the dependency level of the beneficiary, where pension benefits increase in the new state as the cost of care increases. To that end, we propose a model with a benefit correction factor that includes a specific mortality rate for dependents, thus enabling to adapt the benefits to the profile of each beneficiary. Special attention is paid to mortality rates among dependents as the determinant for the correction factor. This new model has many practical implications, as it can be implemented without much difficulty and at no additional cost. This enables coverage to be universalized in private capitalisation-type pension plans. However, it does increase the cost of social security systems funded on a pay-as-you-go basis.

Warning: Long-Term Care is Coming

In 2005 the World Bank extended the 3-pillar protection scheme that it had introduced in the 1990s to a 5-pillar scheme by adding a ‘zero pillar’ coverage tends to offer services with predefined support, in terms of money or service, in line with the degree of dependency of each individual; and the cre ation of a public system would help increase efficiency in all-round coverage.

The outlook for the future is not expected to improve (Campbell et al., 2009; Colombo et al., 2011) since: the number of elderly people is set to increase in most countries, fami ly support for dependents will tend to disappear as families have fewer chil dren, demand for better coverage and care in old age is set to increase, and there will be technological changes that will enable dependents to be cared for in their own homes.

Until the passing of the Dependency Act (Ley de Dependencia) in Spain there was no state-wide assurance of coverage of this type. Germany and France have offered such coverage on a universal basis since 1995 and 1997, respectively (IMSERSO, 2004), and it has also been introduced in other countries including Japan (Campbell et al., 2009, 2010), Luxembourg (Colombo et al., 2011), the Netherlands (Schut and Van den Berg, 2010) and South Korea (Wook-Kim and Jun-Choi, 2013; Chon, 2014). The system in Germany is coordinated in a highly complex manner but in the case of France the level of coordination is low. In Spain, Law 39/2006 on the promotion of personal autonomy and care for persons in situations of dependency (Ley, 2006) establishes three levels of dependency which, as in the other countries mentioned, are funded by the state, by regional communities or by associations of interested parties. The three levels of dependency established in the Spanish legislation regulating dependency are the following:

-

Basic level: essential coverage is provided with funding from the general national administration.

-

Supplementary level: supplementary aid can be provided by Spain’s devolved regional authorities (‘autonomous communities’). To that end agreements are drawn up between the general national administration and the regions.

-

Improvement level: private sector aid is envisaged.

This legislation establishes a scalable system of benefits on three levels that cannot be funded by the public sector alone because of its implications for the financial sustainability of public pension systems (Casado and López, 2001; OCDE, 2005, 2006; Rodríguez, 2007; Puga et al., 2011): its cost could be as high as 9.5% of GDP by 2060 (De la Maisonneuve and Oliveira, 2015). As a result, private sector coverage for dependency is envisaged in the legislation itself (Fernández-Ramos and De La Peña, 2013).

Literature Review

The first step in designing private long-term care (LTC) coverage (Herranz et al., 2008) is to establish precisely what kind of coverage is provided. Services related to everyday activities (Calmus, 2013) or benefits can be offered, and the latter can take the form of capital payments or regular income. Services and financial benefits can also be combined (Colombo et al., 2011), involving both the public and private sectors (Chen, 2001; De La Peña, 2003) to improve their effectiveness. Schemes may also be free to decide what kind of care they finance (Da Roit et al., 2007; Da Roit and Le Bihan, 2010; Damiani et al., 2011).

This normally entails offering a set of measures that meets all the needs of the dependent rather than conventional service coverage (Arksey and Kemp, 2008) such as use of a residence (De la Peña, 2000a), thus providing higher levels of satisfaction and bet ter monitoring of dependents.

Da Roit and Le Bihan (2010) classify the coverage in services in kind (found for instance in the Netherlands or Sweden) or financial benefits for all-round dependency coverage plans (France) or for caring of dependents (Austria, Germany and Italy). Both are provided for chronic illness or physical or mental disability, so as to help achieve and maintain an optimal level of functioning (Worrall and Chaussalet, 2015).

In this scenario, LTC coverage may be considered as an extension of health insurance (Costa-Font et al., 2014) and can protect beneficiaries from the risk of outliving the resources available to them following their retirement (Warshawsky, 2012). Accordingly, we propose to link LTC coverage with retirement pensions so as to extend their effect (Murtaugh et al., 2001; Warshawsky, 2007; Forder and Fernández, 2011; Zhou-Richter and Gründl, 2011; Brown and Warshawsky, 2013). In an earlier paper, Pitacco (2002) proposed to include LTC insurance within the public pension scheme by introducing an improved pension funded with contributions deducted from public retirement pensions.

In the field of private initiative, a distinction is drawn between natural coverage and LTC (Davidoff, 2009; Brown and Warshawsky, 2013), with problems of dependency being alleviated with products suited to demand. The combination of different benefits (Spillman et al., 2003) simplifies matters and includes an important aspect of retirement pensions which is usually dealt with separately: an acknowledgement of the potential need for dependency care, resulting in higher benefits being paid when the beneficiary is dependent. This approach is proposed by Habermann and Pitacco (1999) and Pitacco (2013) as a combination of retirement income and higher income on becoming dependent.

However, the problem is how to fund such a system: as stated (Pitacco, 2002, 2013), it is envisaged that the relevant premiums would be subtracted from retirement pensions. By contrast, other authors (Winklevoss, 1993; De La Peña, 2000b) propose an approach that does not increase the total cost of coverage under the plan but does adapt bene fits to the dependents new state: an actuarial correction (Winklevoss, 1993) or actuarial reduction (De La Peña, 2000b) factor, used in both cases for early retirement.

In the public field, Worrall and Chaussalet (2015) are of the opinion that there is a clear need to assess how the demand and cost of LTC will evolve over the coming years. However, producing accurate forecasts of the demand for LTC is highly complex. In any case, in a pure pay-as you-go model, any change in the pension will affect directly the contribution rate. The notional defined contribution (NDC) scheme (Barr, 2006) divided the state pay-as-you-go (PAYG) scheme into two components: a notional financial account operating on a PAYG basis but replicating a funded defined contribu tion (FDC) scheme, and a factor as redistribution element.

The NDC schemes currently in place focus mainly on old-age pensions, but their application can be extended to other contingencies, such as LTC. The idea of combining retirement and LTC annuities comes naturally to actuarial thinking as a way of improving the diffusion of LTC insurance coverage and finding fair protection and financial sustainability in the long term, without shifting too large a financial burden onto future generations (Colombo and Mercier, 2012).

Methodology

Nowadays, publicly-run LTC schemes recognize at least three degrees of dependence. Dependents are categorized into several levels of dependence according to their inability to perform a given number of activities in daily living. This classification has a direct effect on the amount of benefit paid. However, established degrees of dependence and their legal definition differ notably from country to country. This can be illustrated by looking at the examples of Austria (Fleischmann, 2015), France (Biessy, 2015), Germany (Rothgang, 2010) and Spain (Bolancé et al., 2013). Nevertheless, the uncertainty surrounds the timing of becoming dependent (LTC incidence rates by age) and yearly deterioration probabilities by age (probabilities of moving to a worse state of dependence).

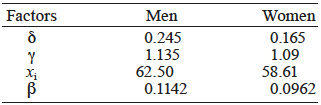

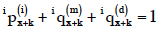

The present model includes realistic demography because it takes into account an age and health sta tus schedule of mortality and the worse state of dependence. We assume that when the beneficiary becomes a severe or high-level dependent at age x the amount of the benefit is automatically increased by a percentage , which helps to pay for dependency care services. Dependent persons are assumed to be unable to recover their previous health status (active or autonomous), following the irreversible illness-death model (Andersen and Keiding, 2002). Before becoming beneficiaries, the contributions have been for retirement, death and invalidity coverage, and the reasons for state change may be death or invalidity when is working and death when is receiving benefits (Figure 1).

Figure 1

Probabilities of transition.

Dependency benefits as such are paid when participants are already receiving other benefits (retirement, invalidity), because lower levels of dependency do not fall under dependency benefits and if dependency ensues while working, initially they would become disabled persons receiving the pension of invalidity. This means that the main technical requirement is to know the probabili ty of death of beneficiaries while classed as dependents, which limits the duration of payments.

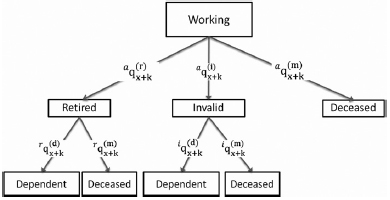

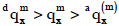

In the actuarial literature on mortality there is unanimous agreement that the mortality rate among dependents is different from and higher than the general mortality rate as expressed in the standard tables used by insurance agencies to assess normal risks, and clearly substantially higher than the mortality rate for autonomous beneficiaries (Sánchez et al., 2008). So, the following relation ratio is accepted:

These probabilities are used to work out the lifelong annuities of severe and high-level dependents.

The study starts from a simplified form of the multi-state transition model (Haberman and Pitacco, 1999) that describes probabilities of transition between various states; working, retired (autonomous), retired (dependent), invalid (autonomous), invalid (dependent) and deceased (Figure 1). This is a discrete mod el with various states for an annual period, where it is assumed that there will be no more than one transition per year and there are no returns to previous states.

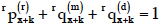

Being

: probability of a working individual aged x+k reaching age x+k+1 as a worker,

: probability of a working individual aged x+k becoming an invalid before reaching age x+k+1, while exposed also to other causes of transition (death and retirement),

: probability of a working individual aged x+k dying before reaching age x+k+1, while exposed also to other causes of transition (invalidity and retirement), and

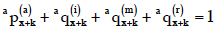

: probability of a working individual aged x+k retiring before reaching age x+k+1, while exposed also to other causes of transition (death and invalidity), the following equivalence is obtained whenever x+k is lower than the retirement age (x+k<xr) for a worker:

which is true for the whole period of activity (retirement age depends on the law in every country).

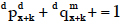

For the invalidity period,

: probability of an invalid individual aged x+k reaching age x+k+1 as an invalid,

: probability of an invalid individual aged x+k dying before reaching age x+k+1, while exposed also to other causes of transition (dependency),

: probability of an invalid individual aged x+k becoming a dependent before reaching age x+k+1, while exposed also to other causes of transition (death).

where for an age x+k at which the beneficiary receives invalidity benefits it holds that

Similarly, as from retirement age,

: probability of a retired individual aged x+k reaching age x+k+1 as a retiree,

: probability of a retired individual aged x+k dying before reaching age x+k+1, while exposed also to other causes of transition (dependency), and

: probability of a retired individual aged x+k becoming a dependent before reaching age x+k+1, while exposed also to other causes of transition (death), the following is obtained:

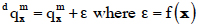

All that remains to be determined is the following for dependents is

: probability of a dependent aged x+k reaching age x+k+1 as a dependent, and

: probability of a dependent aged x+k dying before reaching age x+k+1, where, of course, the sum is one at age x+k:

In our model, if a factor is applied when a beneficiary becomes dependent, then only the probability of death while classed as a dependent remains to be determined. The probabilities of suffering from severe and high-level dependency have been determined in various studies (Fernández-Ramos, 2015), on the basis of which life expectancy figures for individuals in the severest states of dependency have been calculated. The excess mortality rate for dependents over and above the general mortality rate can be expressed via a multiplicative correction factor θ:

This correction may vary from one age group to another, though MacDonald and Pritehard (2001) state that a fixed correction factor fits the mortality rate of high-level dependents better than any other approach. However, this tends to overestimate mortality rates for younger dependents and underestimate those for older dependents. It is therefore better to use an additive adjustment () on the general mortality rate, considering age as an independent variable in a functional form (Rickayzen and Walsh, 2002):

This shows that mortality rates increase in line with the level of dependency and are lower at younger ages, and that no excess mortality applies in the case of less severe dependency (Leung, 2003).

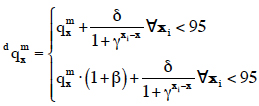

On that basis, Sánchez et al. (2008) determined the probabilities of death among severe and high-level dependency in Spain. They found that the gap between excess mortality and general mortality rates decreases from age 96 onwards. To reflect this effect, they include a variation in Rickayzen and Walsh (2002) formula based on a mixed correction factor applied to general mortality so as to model mortality among dependents. In that mixed correction factor, an additive modification is included under the expression used by Rickayzen and Walsh, and a multiplicative correction factor is applied to the general mortality rates to reflect the decrease in differences in absolute mortality figures in the highest ages on the table:

where : maximum value to be incorporated in line with the age at which figures converge asymptotically, : slope factor, xi: age at the point of inflection where the curve changes from convex to concave, and : multiplicative correction factor applied to general mortality.

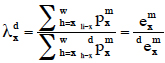

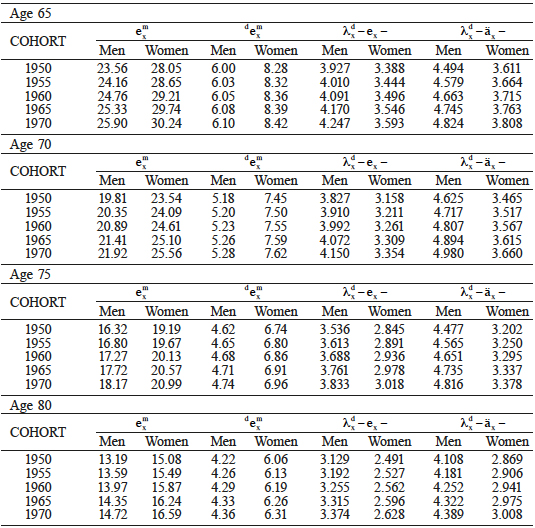

Once the probability of death of severe and high-level dependents is known, the correction factor to be applied is

and if the financial revaluation factor is incorporated, the correction factor for dependency is

where : pension revaluation factor, v: financial revaluation, : actuarial value of a prepayable annuity that varies in geometrical progression at a ratio β, valued at age x and payable so long as the beneficiary remains alive, and : actuarial valule of a prepayable annuity that varies in geometrical progression at a ratio β, valued at age x and payable so long as the beneficiary dependent remains alive.

In this manner, becoming an LTC recipient means that the amount of retirement pension is automatically increased by a certain percentage to help to pay for care services.

Implementing the Model: Results of an Application to Spain

Mortality rates among dependents are usually calculated on the basis of general mortality statistics (Pitocco, 2002). Sánchez et al. (2008) calculate them for and xi with an ordinary least squares procedure for the gross values for high-level dependency estimated for Spain (Table I). They are based on PERM/F-2000P dynamic tables for Spain (DGS, 2000) fitted to HID 98-01 statistics for France (Bontout et al., 2002).

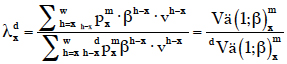

As can be seen in Table II, life expectancy at age 65 differs considerably for autonomous individuals and severe and high-level dependents. Most people classed as dependents are aged over 65, so the life expectancy of not only autonomous beneficiaries but also dependents needs to be factored into pension calculations, as otherwise the life expectancy of elderly people would be overestimated.

Based on PE-2000 tables.

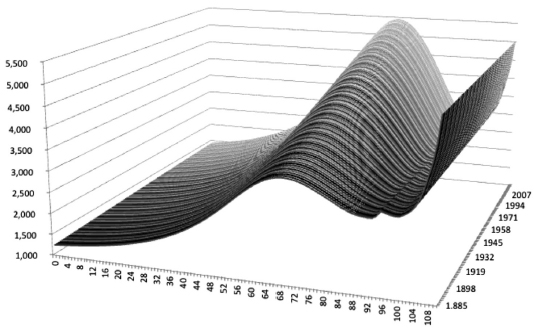

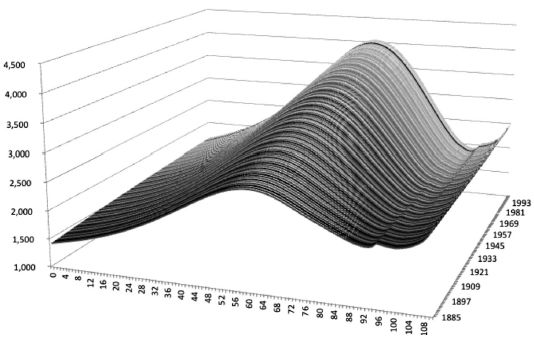

The application of these calculations to severe and high-level dependents in line with their year of birth, becoming dependent at ages 65, 70, 75 and 80, shows pension increases of practically threefold in all cases. If expectancy as regards payment of the various funding flows is applied as a correction factor in all cases, the value that results is higher than that calculated on the ba sis of life expectancy. However, if this correction factor is taken into account throughout the lifetime of each beneficiary, i.e. not only in retirement, then substantial changes are found. At younger ages the correction factor has values of just over one, in sharp contrast with the values found from retirement age onwards.

Figures 2, 3 and 4 show the different values that the correction factor would take if it were extended to an individual’s whole lifetime as a beneficiary of a pension scheme. The last few years of life show high values due precisely to the short life expectancy of severe dependents if they become beneficiary at those ages.

Figure 2

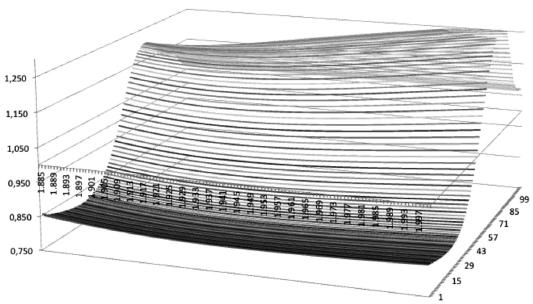

Breakdown by gender of the correction factor for life expectancy λxd/λyd.

Figure 3

Correction factor with actuarial income for dependency broken down by age and generation (men).

Figure 4

Correction factor with actuarial income for dependency broken down by age and generation (women).

As occurs with the correction factor with actuarial income when life expectancy alone is used, the value of the factor increases by less than dou ble in the period of dependency benefits. Subsequently, the figure rises gradually as retirement age approaches until it increases threefold After retirement age the figure begins to drop, but then increases markedly at ages where the life expectancy of severe dependents becomes substantially shorter (from age 90 onwards).

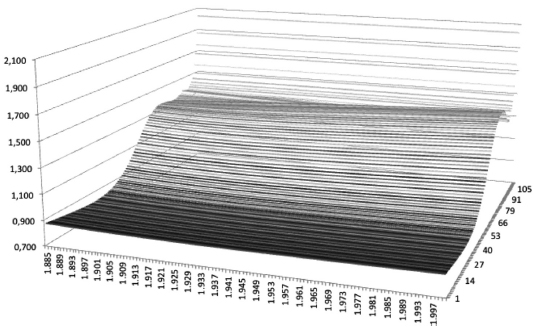

This is in contrast with the values already obtained from retirement age onwards. It is also noteworthy that in a breakdown of beneficiaries by sex (Figure 5) at pre-retirement ages the correction factor for women is higher than for men. This situation is reversed after retirement age, where the figure for men is substantially higher than for women.

Figure 5

Breakdown by gender of the correction factor with actuarial income λxd/λyd.

Discussion

This simpler approach is the one used in public social welfare provisions to link pensions with the life expectancy of pensioners. Several countries, such as Sweden, Poland, Latvia or Norway, have systems in which individuals receive benefits according to their estimated life expectancy and to the contributions that they have made. This mechanism was introduced in Spain (De las Heras et al., 2014) through the estimation of life expectancy at retirement age. On the one hand, this enables individuals to accumulate more entitlements and thus obtain higher pensions by extending their working lives (European Commission, 2012) in the case of retirement benefits. On the other hand, it re-establishes the balance at individual level between contributions paid and pension received, which tends to break down as life expectancy increases. Individuals in different cohorts thus receive similar yields for their efforts in terms of contributions (Meneu et al., 2013).

Some authors assert that coverage for dependency is already integrated into planning at retirement (Yakowosky, 2002), so the likelihood of becoming a dependent is already factored into the income to be received; however, others assert that dependency and the mortality of autonomous beneficiaries are negatively correlated (Murtaugh et al., 2001; Webb, 2009), so a natural selection of demand for each product is created. What is certain is that the factors involved include age and state of health, and there is uncertainty concerning the time when beneficiaries become dependents (Bommier and Lee, 2003). Studies of populations in the UK (Ainslie, 2000; Rickayzen, 2007) and in Norway (Ellingsen, 2010) have found that mortality for dependents is proportional to the level of care needed and to their age.

This is where the study presented here constitutes a step forward: given the uncertainty as to the time when beneficiaries become severe or high-level dependents, a factor is introduced that automatically increases the pension received by beneficiaries (retirement, invalidity or death benefits) when they transition to a state of severe or high-level dependency, taking into account the differences in mortality rates between autonomous beneficiaries and dependent beneficiaries.

Conclusions

The model has many practical implications, and can be implemented with little difficulty and no additional cost, enabling coverage to be universalized in capitalization-based private pension schemes. Such schemes are currently designed according to hypotheses based on a general mortality rate for their beneficiaries that do not factor in specific mortality rates for severe or high-level dependents. Including the correction factor suggested here, together with the tables for mortality among dependents, means that dependency benefits can be included with no need to increase costs or contributions.

However, if this factor were to be included in a public, defined-benefit system such as the pay-asyou-go social security system or a notional accounts system, it would lead to a direct increase in cost equivalent to the amount of the increase in benefits to be received by pensioners classed as dependents. If contributions would not increase, a deficit would initially result.

In any case, dependents seek to reduce the burden of spending brought on by their state. Once they become dependent their expenses increase and the correction factor would provide an increased pension that would not, however, have to be paid directly. For instance, the following alternatives are possible: i) pension increases could be used to refund part of the amount spent on care rather than being paid directly to beneficiaries, or ii) any surplus could then be added to the initial pension.

Both, public and private dependency coverage schemes alike, seek to help meet the costs that dependency entails for individuals, but without necessarily providing all the resources needed to meet demands for coverage. Indi viduals are provided with a set of measures that can meet their needs as dependents in full: services, use of residence and financial benefits, thus providing higher levels of satisfaction and better monitoring of dependents.

This factor contributes by offering an affordable system not presented before. However, the study is not free of limitations that will be overcome in future research. The first is that the developed conversion factor reinforces the fact that biometric assumptions need to be estimated accurately before any decision is made to put the model into practice. Although we have found differenciated mortalities betwen severe dependents and autonomous pensioneers, we have no data about the different degrees or levels of dependent people so as to obtain the transition probabilities from one stage to another. Also, it would be of interest to quantify the effect of this factor not only in the Spanish social security system, but in other countries such as France, Italy or Germany.

Acknowledgements

The authors are grateful to anonymous reviewers for their many insightful and constructive suggestions. This study was supported by Polibienestar Research Institute and Consolidated Research Group EJ/GV: IT 897-16.

REFERENCES

Ainslie R (2000) Annuity and Insurance Products for Impaired Lives. Paper presented to the Staple Inn Actuarial Society, London. 60 pp.

Andersen P, Keiding N (2002) Multi-state models for event history analysis. Stat. Meth. Med. Res. 11: 91-115.

Arksey H, Kemp PA (2008) Dimensions of Choice: A Narrative Review of Cash-for-care Schemes. Working Paper No. DHP 2250. Social Policy Research Unit, University of York. UK. 25 pp.

Barr N (2006). Non-financial defined contribution pensions: Mapping the terrain. In Holzmann R. Palmer E (Eds.) Pension Reform: Issues and Prospects for Notional Defined Contribution (NDC) Schemes. Ch. 4. World Bank. Washington, DC, USA.

Barr N (2010) Long-term care: A suitable case for social insurance. Soc. Policy Admin. 44: 359-374.

Biessy G (2015) Long-term care insurance: A multi-state semi-Markov model to describe the dependency process for elderly people. Bull. Franç. Actuar. 15(29): 41-73.

Bolancé C, Alemany R, Guillén M (2013) Sistema público de dependencia y reducción del coste individual de cuidados a lo largo de la vida. Rev. Econ. Aplic. 61: 97-117.

Bommier A, Lee RD (2003) Overlapping generations models with realistic demography. J. Popul. Econ. 16: 135-160.

Bontout O, Colin C, Kerjosse R (2002) Personnes Agées Dépendantes et Aidants Potentiels: Une Projection à L’horizon 2040. Direction de la Reserche des Etudes de L´evaluation et des Statisques, Etudes et Résultats, 160. Paris, France. 11 pp.

Brown J, Warshawsky M (2013) The life care annuity: a new empirical examination of an insurance innovation that addresses problems in the markets for life annuities and long-term care insurance. J. Risk Ins. 80: 677-703.

Calmus D (2013) The Long-Term Care Funding Crisis. Center for Policy Innovation DP 7.

Campbell JC, Ikegami N, Kwon S (2009) Policy learning and cross-national diffusion in social long-term care insurance: Germany, Japan, and the Republic of Korea. Int. Soc. Secur. Rev. 62(4): 63-80.

Campbell JC, Ikegami N, Gibson MJ (2010) Lessons from public long-term care insurance in Germany and Japan. Health Aff. 29: 87-95.

Casado D, López G (2001) Vejez, Dependencia y Cuidados de Larga Duración en España. Fundación La Caixa. Barcelona, España. 240 pp.

Chen YP (2001) Funding long-term care in the United States: the role of private insurance. Geneva Papers on Risk and Insurance Issues and Practice 26: 656-666.

Chon Y (2014) The Expansion of the Korean welfare state and its results. Focusing on long-term care insurance for the elderly. Soc. Policy Admin. 48: 704-720.

Colombo F, Mercier JA (2012) Help wanted? Fair and sustainable financing of longterm care services. Appl. Econ. Persp. Policy 34: 316-332.

Colombo F, Llena-Nozal A, Mercier JA, Tadens F (2011) Help wanted? Providing and paying for long-term care. OECD Health Policy Studies. OECD. Paris, France. 324 pp.

Costa-Font J, Courbage C, Zweifel P (2014) Policy Dilemmas in Financing Long-Term Care in Europe. LSE Health Working Paper Nº 36/2014. London, UK. 18 pp.

Damiani G, Farelli V, Anselmi A, Sicuro L, Solipaca A, Burgio A, Iezzi DF, Ricciardi W (2011) Patterns of long term care in 29 European countries: evidence from an exploratory study. BMC Health Serv. Res. 11: 316.

Da Roit B, Le Bihan B, (2010). Similar and yet so different: cash-for-care in six European countries’ long-term care policies. Milbank Quart. 88(3): 286-309.

Da Roit B, Le Bihan B, Österle A, (2007). Longterm care policies in Italy, Austria and France: variations in cash-for-care schemes. Soc. Policy Admin. 41: 653-671.

Davidoff T (2009) Housing, health, and annui ties. J. Risk Ins. 76: 31-52.

De la Maisonneuve C, Oliveira J (2015) The future of health and long-term care spending. OECD J. Econ. Stud. 2014: 61-96.

De La Peña JI (2003) El impacto del envejecimiento de la población en el seguro de salud y de dependencia. Papeles Poblac. 35: 47-72.

De La Peña JI (2000a) Más allá del seguro de dependencia: el seguro de residencia. Actualidad Financ. 10: 37-54.

De La Peña JI (2000b) Planes de Previsión Social. Pirámide. Madrid, España. 784 pp.

De Las Heras A, Gosalbez MB, Hernández D (2014) The sustainability factor and the Spanish public pension system. Econ. Esp. Protec. Soc. 6: 119-157.

DGS (2000) Resolución de 3 de Octubre de 2000, de la Dirección General de Seguros y Fondos de Pensiones, por la que se Da Cumplimiento a lo Previsto en el Número 5 de la Disposición Transitoria Segunda del Reglamento de Ordenación y Supervisión de los Seguros Privados, Aprobado por Real Decreto 2486/1998, de 20 de Noviembre, en Relación con las Tablas de Mortalidad y Supervivencia a Utilizar por las Entidades Aseguradoras. BOE 244, de 11 de octubre. Madrid, España. pp. 34882-34895.

Ellingsen TM (2010) Mortality among disability pensioners. Trans. 29th Int. Cong .of Actuaries. 07-12/03/2010. Cape Town, South Africa.

European Commission (2012) The 2012 Ageing Report. Economic and Budgetary Projections for the 27 EU Member States (2010-2060). Economic and Financial Affairs. European Economy 2|2012.

Fernández-Ramos MC (2015) Soluciones Pragmáticas en el Campo Privado para la Cobertura de la Dependencia en España. Thesis. Universidad del País Vasco. Bilbao, España. 336 pp.

Fernández-Ramos MC, De La Peña JI (2013) Legislative development of protection for dependence. Opportunities for the private sector: The case of the Castilla and Leon region, Spain. Rev. Estud. Region. 97: 113-136.

Fleischmann A (2015) Calibrating intensities for long-term care multiple-state Markov insurance model. Eur. Actuar. J. 5: 327-354.

Forder J, Fernández JL (2011) What works abroad? Evaluating the funding of long-term care: International perspectives. Report commissioned by Bupa Care Services. PSSRU Discussion Paper 2794. PSSRU. Canterbury, UK. 46 pp.

Guillén M, Comas-Herrera A (2012) How much risk is mitigated by LTC insurance? A case study of the public system in Spain. Geneva Papers on Risk and Insurance Issues and Practice 37(4): 712-724.

Haberman S, Pitacco E (1999) Actuarial Models for Disability Insurance. Chapman and Hall. London, UK. 280 pp.

Herranz P, Guerrero FM, Segovia MM (2008) Long term care insurance actuarial model. Rev. Mét. Cuant. Econ. Empr. 6: 42-73.

Holzmann R, Hinz R (2005) Old-Age Income Support in the 21st Century. An Inter national Perspective on Pension Systems and Reform. World Bank. Washington, DC, USA. 229 pp.

IMSERSO (2004) Atención a las Personas en Situación de Dependencia en España. Libro Blanco. Ministerio de Trabajo y Asuntos Sociales. Madrid. http://www.dependencia.imserso.es/InterPresent1/groups/imserso/documents/binario/libroblanco.pdf

Leung E (2003) Projecting the Needs and Costs of Long Term Care in Australia. Research Paper 110. Centre for Actuarial Studies. University of Melbourne. 34 pp.

Ley (2006) Ley 39/2006, de 14 de diciembre, de Promoción de la Autonomía Personal y Atención a las Personas en Situación de Dependencia. BOE-A-2006-21990. Jefatura de Estado. Madrid, Spain.

Macdonald A, Pritchard D (2001) Genetics, Alzheimer’s and long-term care insurance. North Am. Actuar. J. 5(2): 54-78.

Meneu R, Devesa JE, Devesa M, Nagore A, Domínguez I, Encinas B (2013) The sustaninability factor: alternative designs with an actuarial and financial valuation of its effects over the parameters of the system. Econ. Esp. Prot. Soc. 4: 63-96.

Miyazawa K, Moudoukoutas P, Yagi T (2000) Is public long-term care insurance necessary? J. Risk Ins. 67: 249-264.

Murtaugh CM, Spillman BC, Warshawsky MJ, (2001). An Annuity Approach to Financing Long-Term Care and Retirement Income. J. Risk Ins. 68: 225-254.

OECD (2005) Long-Term Care for Older People (2001-2004). The OECD Health Project.

OECD (2006) Projecting OECD Health and Long-Term Care Expenditures: What Are the Main Drivers? Economics Department Working Papers No. 477. OECD. 81 pp.

Pitacco E (2002) Longevity Risk in Living Benefits. Working Paper 23/02. Center for Research on Pensions and Welfare Policies. 37 pp.

Pitacco E (2013) Biometric Risk Transfers in Life Annuities and Pension Products: A Survey. Working Paper 2013/25. Center for Research on Pensions and Welfare Policies. 34 pp.

Puga MD, Sancho M, Tortosa MA, Malmberg B, Sundström G (2011) Diversification and strengthening of services for older people in Spain and Sweden. Rev. Esp. Salud Públ. 85: 525-539.

Rickayzen BD (2007) An Analysis of DisabilityLinked Annuities. Actuarial Research 180. Cass Business School. London, UK. 52 pp.

Rickayzen BD, Walsh DEP (2002) A multi-state model of disability for the United Kingdom: Implications for future need for long-term care for the elderly. Br. Actuar. J. 8: 341-393.

Rodríguez P (2007) Hacia la definición de un modelo de intervención en las situaciones de dependencia. Bases para la planificación. Primeras Jornadas Nacionales sobre Planificación en Servicios Sociales. Gobierno de La Rioja. Spain.

Rothgang H (2010) Social insurance for long term care: an evaluation of the German model. Soc. Policy Admin. 44: 436-460.

Sánchez E, López JM, de Paz S (2008) La corrección de los tantos de mortalidad de los dependientes: una aplicación al caso español. An, Inst. Actuar. Esp. 13: 135-151.

Schut F, van den Berg B (2010) Sustainability of comprehensive universal long-term care insurance in the Netherlands. Soc. Policy Admin. 44: 411-435.

Spillman BC, Murtaugh C, Warshawsky MJ (2003) Policy implications of an annuity approach to integrating long-term care financing and retirement income. J. Aging Health 15: 45-73.

Warshawsky MJ (2007) The Life Care Annuity - A Proposal for an Insurance Product Innovation to Simultaneously Improve Financing and Benefit Provision for LongTerm Care and to Insure the Risk of Outliving Assets in Retirement. Working Paper Nº 2. Georgetown University Health Policy Institute. Washington, DC, USA. 30 pp.

Warshawsky MJ (2012) Retirement Income: Risks and Strategies. MIT Press. Cambridge, MA, USA. 280 pp.

Webb DC (2009) Asymmetric information, longterm care insurance, and annuities: The case for bundled contracts. J. Risk Ins. 76: 53-85.

Winklevoss HE (1993) Pension Mathematics with Numerical Illustrations. 2nd ed. University of Pennsylvania Press. 344 pp.

Wook-Kim J, Jun-Choi Y (2013) Farewell to old legacies? The introduction of long-term care insurance in South Korea. Ageing Soc. 33: 871-887.

Worrall P, Chaussalet T (2015) A structured review of long-term care demand modelling. Health Care Manag. Sci. 18: 173-194.

Yakoboski PJ (2002) Understanding the motivations of long-term care insurance owners: The importance of retirement planning. Benef. Quart. 2002(2): 16-21.

Zhou-Richter T, Gründl H (2011) Life care annuities - Trick or treat for insurance companies? Technical Report. http://www.ssrn.com/abstract=1856994

Zuchandke A, Reddemann S, Krummaker S, von der Schulenburg J-MG (2010) Impact of the introduction of the social long-term care insurance in Germany on financial security assessment in case of long-term care need. Geneva Papers on Risk and Insurance Issues and Practice 35(4): 626-643.

Author notes

Alternative link

https://www.interciencia.net/wp-content/uploads/2018/01/9-43_1.pdf (pdf)